Table of Contents

Farmer Loan Scheme Pakistan – Complete Overview

The Farmer Loan Scheme Pakistan is one of the most sought initiatives by the government which is concerned with the farmers’ welfare throughout the country. Given the escalation of input costs, a number of farmers look for information online about how to apply online, who is eligible, what is the loan amount, what is the interest rate, and what are the repayment terms regarding this scheme.

What Is Farmer Loan Scheme Pakistan?

The Loan Scheme Pakistan is a state-supported agriculture financing project that is aimed at giving farmers easy access to loans at affordable markup rates. This scheme’s prime objective is to reinforce the country’s agriculture sector and assist the farmers in financial trouble during times of harvest.

The scheme is open for both individual farmers and registered growers.

Objectives of Farmer Loan Scheme Pakistan

The Farmer Loan Scheme’s principal aims are as follows:

- Offer cash infusion to the farmers

- Raise the amount of agriculture produced

- Put an end to farmers borrowing from private lenders

- Introduce modern agricultural practices

- Assist China in achieving its food security goal

The said objectives render the scheme extremely significant for the agricultural sector.

Farmer Loan Scheme Pakistan Apply Online – Step by Step Process

“ Loan Scheme Pakistan apply online” is one of the most frequent asked questions. The general application process consists of:

- Navigate to the official government portal or partner bank website

- Choose Farmer Loan/Agriculture Loan option

- Type CNIC and some basic personal details

- Give land ownership or tenancy data

- Type crop or farming details

- Scan and send the required documents

- Hand in the application

Once sent, the application goes to the appropriate authority or bank for review.

Eligibility Criteria for Farmer Loan Scheme Pakistan

The eligibility criteria to be a part of the loan scheme is one of the most frequently searched keywords by the farmers. The applicants are required to meet the following criteria:

- She/he must be a Pakistani citizen

- Must have a valid CNIC

- Must be involved in farming on a full-time basis

- Must own or hold on lease agricultural land

- Must meet the criteria defined by the bank or government

Small farmers are usually prioritized in this scheme.

Required Documents for the Loan Scheme

The following documents must be provided by the applicants:

- Copy of CNIC

- Ownership or leasing documents of the land

- passport-size photos

- farming or crop information

- bank account details

The submission of the necessary documents aids in the rapid processing of the loan.

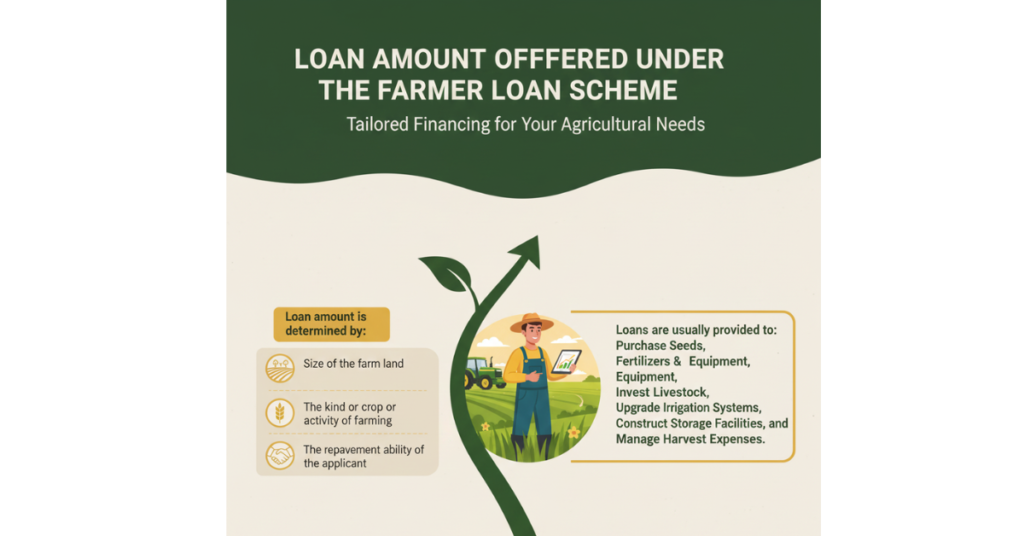

Loan Amount Offered Under the Farmer Loan Scheme

One of the most frequently asked questions is “Loan amount of Farmer Loan Scheme”. The amount of loan is determined by:

- Size of the farm land

- The kind of crop or activity of farming

- The repayment ability of the applicant

Loans are usually provided to meet the costs of seed, fertilizer, pesticides, irrigation, and equipment, etc.

Interest Rate & Repayment Plan

The Loan Scheme Pakistan interest rate is lesser than that of private loans. In some instances, small farmers are given subsidized or interest-free loans.

Repayment arrangements are made keeping in mind the seasons of crop harvesting so that the financial burden on farmers is not that much.

Banks & Institutions Offering Farmer Loans

Various banks and financial institutions that are government-approved and have been participating in the Farmer Loan Scheme disburse loans under government supervision. These banks scrutinize the applications and accordingly release the money.

This partnership guarantees that the funds are utilized in a transparent manner and are proper.

Farmer Loan Scheme Pakistan Provides Numerous Advantages

The scheme is beneficial in many ways, such as:

- easier access to agri-financing

- low markup rates

- different repayment options

- assistance in the production of crops

- better farmers’ lives

These benefits denote the great significance of the scheme to the agriculture sector of Pakistan.

Main Causes of Loan Refusal

A few applications can be rejected for the reasons of:

- not enough paperwork

- land records being wrong

- poor record of repayments

- misleading information

To be on the safe side, applicants should provide precise information.

Farmers are up to date with the latest developments of the Farmer Loan Scheme Pakistan

Farmers mostly inquire about the latest updates regarding the new loan phases, the increased loan limit, and the government subsidies. The updates are done regularly by the official channels and partner banks.

Farmer Loan Scheme vs. Private Agricultural Loans

Side by side with private banking loans, the Farmer Loan Scheme Pakistan gives:

- lower borrowing costs

- government-backed assurance

- clear-cut policies and rules

- repayment plan suitable to farmers

This is how it becomes a more secure option for farmers.

FAQs:

1. Will the Farmer Loan Scheme Pakistan still be in effect in 2025?

Indeed, the program is already in operation and can be accessed through banks that receive government support.

2. What is the procedure to apply for Loan Scheme Pakistan online?

The official website or the websites of participating banks are the platforms where you can submit an online application.

3. Is the Farmer Loan Scheme free of interest?

The categorization of farmers and government policy will determine whether the loans are subsidized or completely interest-free.

4. What are the criteria for farmer loan eligibility in Pakistan?

Only small and medium-sized farmers who can prove their eligibility will be allowed to apply.

5. How long does it generally take for a loan to get approved?

Loan approval timing is different for different cases; usually, it takes a few weeks after documents are verified.

6. Are tenant farmers permitted to apply for this loan?

Tenant farmers are allowed to apply provided they submit tenancy proof that is valid.